Bidder Survey for the State Controller's Office California State Payroll System (CSPS)

Project Background

The SCO currently relies on a number of aging and inflexible information systems that limit the state’s ability to transform and modernize business operations. These older systems do not meet stakeholder expectations for access to accurate and timely data, decision support, and transparency. Additionally, integration with other systems is costly and difficult. The lack of modern functionality in these legacy systems leads to significant data and process duplication across state government as agencies have been required to meet these needs on their own. The CSPS Project seeks to address these issues through business process transformation supported by the replacement of core legacy systems.

The SCO’s systems infrastructure is complex, fragile, and requires nearly constant monitoring by information technology staff. As a result of the inability to easily and quickly make system changes, a significant amount of transactional backlog is created when mandated changes are implemented. To manage this, state staff utilize numerous spreadsheets and desktop databases to verify and track transactions and costs. These offline systems and processes lead to duplicate sources of data that may contain potentially conflicting information.

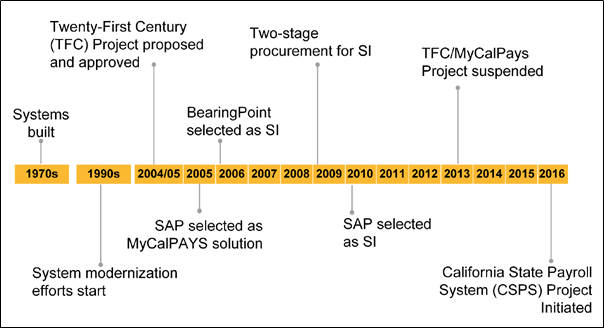

The SCO’s effort to modernize its payroll system has a long history. The timeline below provides a high-level overview of the Project’s history.

Figure 2.1-1 Project History

SCO maintains the Uniform State Payroll System (USPS). The USPS is comprised of various systems, tools, and applications, which include, but are not limited to, the following:

SCO employees developed these systems over time as business requirements became increasingly complex. While there are interfaces between the various systems, the systems designed are separate applications and are not integrated. As a result, SCO exerts an enormous amount of effort to maintain the systems in a way that meets the State of California’s business needs.

The figure below identifies several key challenges of the CSPS Project.

Figure 2.1-2

2. Current Environment

This section summarizes the six (6) main business capabilities supported by the current state.

Position Control

Position Control includes the establishment, modification (classification, funding source, reporting structure, etc.) and abolishment of positions.

There is no single, standard application that supports all position control functions across the state. Rather, there are disparate tools and manual processes at the agency level that provide some support for position-related operational needs. As a result, position control management is limited and inconsistent across the state agencies. Similarly, validation of position related actions is manual, resulting in errors, inconsistencies, and lack of timeliness in processing updates.

Reporting and trend analysis of position control actions and data is difficult as a result of this fractured environment. In fact, position related information is often produced by budgeting processes at an agency level rather than centrally.

Personnel Administration

Personnel Administration includes the management of employee data, such as personal information (address, contacts, demographics, payment preferences), position and employment information (position, work locations, tax, compliance, and retirement, tax (W-4), and compensation information), and status (active, temporarily separated or permanently separated).

The primary system for supporting these functions is the Employee History (EH) system. This is a custom, in-house developed application that is maintained by SCO, and must be updated regularly in response to frequently changing operational needs. Because of limitations within EH, agency specialists have developed workarounds and manual processes to support work that falls outside of standard processing - a situation that occurs frequently with such a large employee base. In turn, this results in issues with data accuracy, timeliness, and consistency with other applications.

Retirement processes, employee transfers, lump sum payouts for separating employees, and managing disability processes are all manually intensive and prone to lack of timeliness. Because of this, HR specialists are often required to double-check information, a time-consuming step that can add to a backlog of personnel actions. In turn, agency HR specialists are somewhat distrustful of the data in the EH system, helping to perpetuate a cycle of added manual work.

Finally, because of lack of integration, EH data is often copied to other agency-level systems for tracking and to support daily operations. Again, this results in multiple data sources that are often not in sync, and an inability to work with a "single source of truth".

Benefits Administration

Benefits Administration includes functions required to manage elective benefits such as health programs (medical, dental, vision), insurance, savings, and flexible spending plans.

Current state systems and processes manage benefit eligibility, enrollment (including both open enrollment and permitting event enrollment) for medical and dental and premier vision health benefits, long-term disability, group legal, life insurance, flexible spending plans, and miscellaneous deductions (e.g. Memberships, Bona Fide Associations, Banks/Savings and Loans, Credit Unions and Industrial Loans). These processes are inefficient, manual, and often error-filled, requiring employees to fill out forms and submit them for validation and processing where they are keyed into the system by a specialist. A file is then generated and sent to the third-party provider for enrollment or changes, resulting in additional opportunities for errors and delays due to backlogs. The current state also manages additional information needed for some benefits such as dependent tracking, age, and salary requirements that must also be communicated to the third-party when changes are needed. For health-related benefits, the current state also manages COBRA notifications.

Finally, the current state manages auto-enrollment for selected benefits for basic vision, employee assistance program, basic group term life insurance and survivor benefits and processes enrollments from third parties for some benefits like Savings Plus.

The state's employment benefit programs require employees to interact with several organizations in managing their benefit elections introducing additional complexity into the process. Each of these organizations has its own systems to manage plan data, premiums, eligibility and enrollment data, etc. As an example, CalPERS manages medical benefit plans, SCO manages the dental plans, and VSP (third-party carrier) manages the enhanced vision plan.

The state share of benefit costs are calculated during payroll runs, and payments are made based on the contractual needs or policies in place for each organization receiving funds.

Time Management

Time Management includes functions required to manage employee work schedules; enter, validate, approve and process time and leave; manage FMLA and Catastrophic Leave programs, manage leave benefits and track service credits and seniority points.

The California Leave Accounting System (CLAS) is used to track leave balances for some, but not all, state agencies. Agencies not using CLAS use their own applications, which create data that must be interfaced to payroll. These interfaces require ongoing maintenance, and in some cases, validation for leave-related transactions does not occur until the data gets to the payroll application. In those situations, errors are reported back to the source well after the initial entry. This results in duplicate effort, errors, and lack of timeliness in leave data.

Time management functions are also impacted by complicated business rules, especially in agencies such as CalFire that have complex work schedules and time entry requirements. The inability to automate support for these requirements has resulted in the creation and deployment of agency-level systems that add to the fragility of interfaces to payroll. Because time management functions are central to daily operations, there is an increasing sense of urgency in resolving these issues.

Payroll

Within the SCO’s seven Divisions, the Personnel/Payroll Services Division (PPSD), in conjunction with the Administration and Disbursements Division (ADD) and the State Accounting and Reporting Division (SARD), administers the payroll.

Under mandate, SCO administers a Uniform State Payroll System (USPS) for state agencies and the California State University (CSU) campuses. SCO maintains personnel and benefit records, manages time entry for most agencies, and imports payroll files from the employing agencies/campuses responsible for reporting various personnel/payroll changes. These daily activities serve as the basis for updating the employment and payroll files. SCO issues employees their salaries or wages and performs all of the State’s payroll accounting and disbursement operations.

Upon receipt of the payroll warrants issued by SCO, the agencies/campuses verify that each warrant (i.e., paycheck) is drawn correctly. All correct warrants are released to the employees and incorrect warrants are returned to SCO and redeposited. Corrected warrants are subsequently reissued based on corrected attendance information and personnel change documents.

For the majority of State employees (approximately 195,000) SCO prepares the payrolls a week or more prior to the receipt of attendance reports (Payroll Current) with negative attendance (exception) reporting. Payroll warrants are sent to the agencies in time to perform a reconciliation of the payrolls and attendance reports, and to ensure the timely delivery of the warrants to employees on the last working day of the pay period. Because attendance reports arrive after payroll has been calculated and run, a great deal of effort is expended on reporting and correcting discrepancies during the processing window and correcting invalid leave entries on the next payroll cycle.

For approximately 30,000 employees, SCO prepares the payrolls after receipt of the attendance reports (Payroll in Arrears) with positive attendance reporting. Typically, these payroll warrants are released to the agencies/campuses by the fifth working day after the receipt of the attendance reports. The employing agency/campus may release the warrants to state employees immediately or hold the warrants for distribution on fixed dates. Payroll warrants issued under this schedule are for:

The State pay plan consists of twelve nearly equal pay periods each year (except for academic and bi-weekly paid employees and statutory officers). Each pay period contains either 21 or 22 normal workdays and will be a calendar month except when more than 22 or less than 21 normal workdays fall within a month. In those cases, the pay period may end one day before or after the end of a calendar month. For employees paid every other week (bi-weekly), their salaries are paid on an average of twenty-six pay periods each year.

Most of FLSA non-exempt hourly employees are paid monthly requiring the current state payroll system to track excess hours (the difference between monthly pay period and the employee work schedule). This results in a liability of excess hours that the state must pay out.

In addition to calculating and distributing employee pay, the current state system is also responsible for the distribution of third-party vendor payments using a complicated process called "business month". This process includes the usage of a series of transaction codes, manual entry and verifications and various reports to manage third-party payments, interaction with the State Treasurer's Office and financial interfaces. The process also supports operational and management reports, audit needs, and statutory reports.

The payroll interface to the state's legacy financial system is complex using a "clearance" system that creates Legacy Fiscal accounting transactions directing funds transfers for employee and third-party payments and "cross-walk" between Legacy Fiscal and FI$CAL and data for the warrant reconciliation system.

Travel and Expense Management

The SCO Personnel and Payroll Services Division (PPSD) operates and maintains the California Automated Travel Expense Reimbursement System (CalATERS) as a service to state departmental accounting offices and employees. In 2000, CalATERS was designed to provide an efficient electronic solution to replace the mainly manual, labor and time intensive expense claim reimbursement process for travel incurred on behalf of the State. CalATERS was also designed to reduce processing costs. In 2007, Government Code Section 19822.3 mandated that all state agencies use CalATERS (with limited exceptions). In 2013, CalATERS was upgrated to CalATERS Global Expense Reporting System (referred to as "Global") to become compliant with the Americans with Disabilities Act (ADA), to allow for additional functionality in cost accounting, and to be compatible with Apple and Citrix environments. In 2014, the Contractor for CalATERS announced the sunset of their Global system, which prompted the need to acquire a replacement solution.

The CalATERS Replacement Project (CRP) was launched to combine data from travel advances, the full or partial recovery of those advances, reimbursement of travel and business expenses, and auditing functionalities into configurable workflows driven by business rules. The CRP scope included an estimated 25 system-to-system interfaces from both internal and external entities, and requirements for both static and ad hoc reporting.

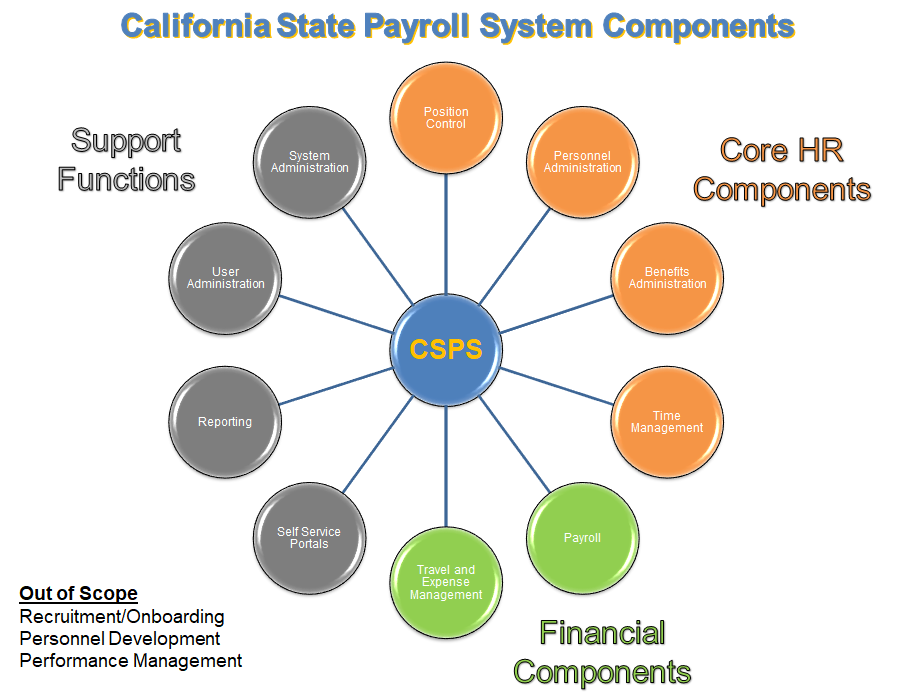

In May, 2021, SCO withdrew the CRP from the CDT PAL process, and moved the scope and requirements into the CSPS project as the Travel and Expense Management business capability as depicted in Figure 2.1-1 below.

3. Proposed Environment

The Contractor must provide a Human Capital Management (HCM) Solution that seamlessly integrates the functions outlined in the Figure 2.1-1 below. A high-level description of each function is provided in Table 2.1-1.

Figure 2.1-1 Solution Components

Prospective Bidders will respond to each Requirement in the attached Bidder Survey response document.

CRM / Application Management

Budget Exists

Challenge-Based Procurement

June 30 through August 6, 2021 at 11:59 PM (GMT-08:00) Pacific Time (US & Canada)

© 2020 California Department of Technology - OSTP. All rights reserved.